There is no such thing as a “no-cost” loan. But these options may help.

Commercial RE Appraisal Changes

Did you know? On April 9, 2018, the FDIC changed their rules. Per the federal agencies, commercial real estate transactions below $500,000 will no longer be required to have an appraisal.

Remember, just because the FDIC doesn’t require something… that doesn’t mean your local lender or bank won’t.

Want to read the full rules? Check them out here.

If you need help getting prepared for your next investment or business purchase, give us a call.

Jen Hudson

(206) 293-1005 or jen@hudsoncreg.com

Duane Petzoldt

(425) 239-1780 or duane@hudsoncreg.com

Water Rights. A Pretty Dry Topic. by Jennifer Hudson

In case you missed it, Washington State had an emergency for the last two years… and it was over who got to make decisions about water.

What am I talking about?

Let’s go back to the beginning.

At first glance, water rights or water claims don’t seem like they should be that complicated. It’s just water. We have lots of water.

But, then you start to think about it for a moment… and immediately confusion sets in.

I’ll try to simplify.

In Washington State, we have the Department of Ecology. Call them the DOE, since it looks cool. The DOE are the “big dogs” when it comes to all things water.

While I can’t explain how they reach their conclusions, the DOE looks at where water flows, how much we have, what it is used for, and so on.

Now… my overly simplified version of water rights or water claims.

The Department of Ecology says that water rights belong to the state and that an individual or group can be granted “rights” to use a certain amount of water, for a specific purpose, and in a specific place.

They care a lot about both fish and people. So, what does the DOE look at?

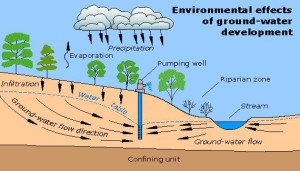

Imagine that it rains in your front yard. The DOE might be able to tell you not only where those rain drops go after they soak into the ground, but also how long it takes those drops to get there. Does it take 1 month for the drops to make it to the pond, and then a year to make it to a stream, and then 20 years to make it to the ocean? Maybe.

Does the DOE put little individual trackers on rain drops to see exactly where they scatter too? Probably not.

However, the DOE is likely the most reliable source for predicting exactly where water goes over time than anyone else in the State. So, they get a lot of points for that.

If you wanted to build a house, or a shopping center, or a ranch, or even a farm, it is likely that the DOE is involved. After all, they get to determine if there is enough water to feed your family or your herd of cattle or even to water your tomatoes.

Who actually uses water from the ground?

I hope you paused just for a moment with that question. Everyone does. Let’s not get off topic. Not everyone know how water gets to your faucet.

How are water rights decided?

There are over 230,000 active water right certificates, permits, applications, and claims that the DOE manages to make sure the state can meet all the water supply needs.

With so many people needing water, and no actual guarantee there will be enough, the DOE uses a system called “the doctrine of prior appropriation.” This is fancy talk for “first in time, first in right.” Essentially, if there is a water shortage, then the senior water rights get their water first and the junior (meaning younger) rights can be slowed or taken away.

What does it take to issue a water right permit?

They have a four-part test, to make it simple.

- Water must be both physically and legally available. Not only does there need to be actual water there, but there needs to be enough water after everyone else ahead of you in line has a drink from the faucet.

- Water must be used beneficially… no wasting please.

- Water use must be in the public’s interest. For example, in the Gremlins movie, spilling water on Gizmo is a bad idea because it spawns Gremlins which are evil little monsters who are not in the public’s best interest. You probably don’t get a water right permit for Gremlins.

- Water use must not impair another existing use. No stealing. Pretty simple.

Wait. There’s a catch. The continuous use rule.

Even if you are the oldest water right at the very beginning of the line, if you stop using your water for 5 consecutive years, then you lose your spot in line and the state takes their rights back.

How does the state know whether or not you are using water?

That part is easier than you think.

In many parts of Eastern Washington, think of things like satellite images or even google streets. If your property is the only brown one surrounded by a sea of green, then odds are you aren’t watering your plants. The same is true in the reverse. If you are the only green field among a bunch of brown ones, then you are probably using water when you shouldn’t. Neighbors and local departments tend to watch these things.

Now for the Definitions.

There are a few terms you hear around water rights. A water right permit is just that. It is a permit to develop a water right.

- Permit – A Water Right Permit is an authorization to use a specific amount of water in a specific place, during a certain season, and with a specific purpose. Whew!

- Certificate – A Water Certificate documents a “perfected” water right put to it’s full use and recorded in appropriate county on the deed for that property.

- Adjudicated Certificate – A Certificate that has not only been in use and recorded, but also validated by a local superior court… which means someone questioned it earlier. Adjudication is a special court process that determines if something is legally valid. So, adjudicated certificates are pretty solid.

- Claim – A water claim is an old water right that so old it came before the current water permitting system (prior to 1917 for surface water and prior to 1945 for ground water). If anyone questions these claims, then the only way they can be confirmed is through adjudication.

- Trust Water Right – This is the safety button so you don’t lose your place in line. If you know that you will not use your water rights for a while, but you don’t want them to be taken away, you can place your water right into the Trust Water Rights Program to protect it from relinquishment due to non-use.

While all these names are all different, they provide similar benefits… such as access to water.

This leads us to the simple question.

Do you need a water right? I’m glad you asked.

As with most things real estate… it depends.

It is important to realize there is a difference in the rules between water that is above ground and water that is below.

Surface water is the water above ground. Think water from streams, rivers, lakes, springs. If you ever want to use surface water in any way at all… you will need a water right to do so.

Ground water is a little different. Think drilling wells, tapping into aquafers, joining a community water system, or even a public utility district. If we are talking about using ground water, there are some exemptions that let you just use the water when you needed it from below the surface.

Side bar: We were told for many years that surface water and ground water are different… but if all the water from the surface (rainfall to steams to rivers, etc) eventually runs below the ground to the aquifers… then why are there different rules? I don’t have the answer. Just a lot of questions.

Those exemptions are:

- A single user or group of domestic uses that use less than 5,000 gallons per day;

- Industrial uses of less than 5,000 gallons per day;

- Irrigation and non-commercial uses of less than one-half acre of lawn or garden; or

- Stock water… for things like cows.

As a point of reference, most households use around 200 gallons per day. Some mature trees use more than that. Some use far less.

Previously, we had a system for who got to use water. Let’s just sum up the issue of who decides whether you can use water varies depending on the location you are in. The DOE had rules relating to seniority of water rights, watershed plans, growth areas, etc. The goal is protect water quality, availability, and all things that surround it.

If you were joining a community system or municipality, you would get a water availability letter showing they had enough water to share with you. If you needed to drill your own well and were not exempt from above, then it got a little trickier.

In theory, if you had an old water right and wanted to move it to a new location… as long as you were pulling water from the same source, it was ok to transfer.

What happened in 2016?

Whatcom County got in a fight with Eric Hirst over water. In the initial court case, the decision ended up turning everything we used to know about water on its head. This single decision (turning that time from 2016-2018) had completely changed how counties approved or denied building permits for homes that we thought were permit-exempt wells for a water source.

So what happened next?

Essentially, the local counties had to become experts in all things water… overnight and without warning. No offense to most counties and cities out there, but they never had to be the water expert before… so how do you think it went when they now had to make decisions?

It went how you would imagine.

Some cities and counties said “no more building permits for you”. Some of them said “we will give you this building permit, but you can’t have any water.” Some of them said “you can build whatever you want, but you don’t get your building permit until you promise not to sue us if we’re wrong.” To be blunt, it was a mess. There was no clarity. Land values where water was questionable sunk overnight. Land values where water was clearly available went up and saw bidding wars. In certain areas, people began purchasing land just for the water rights.

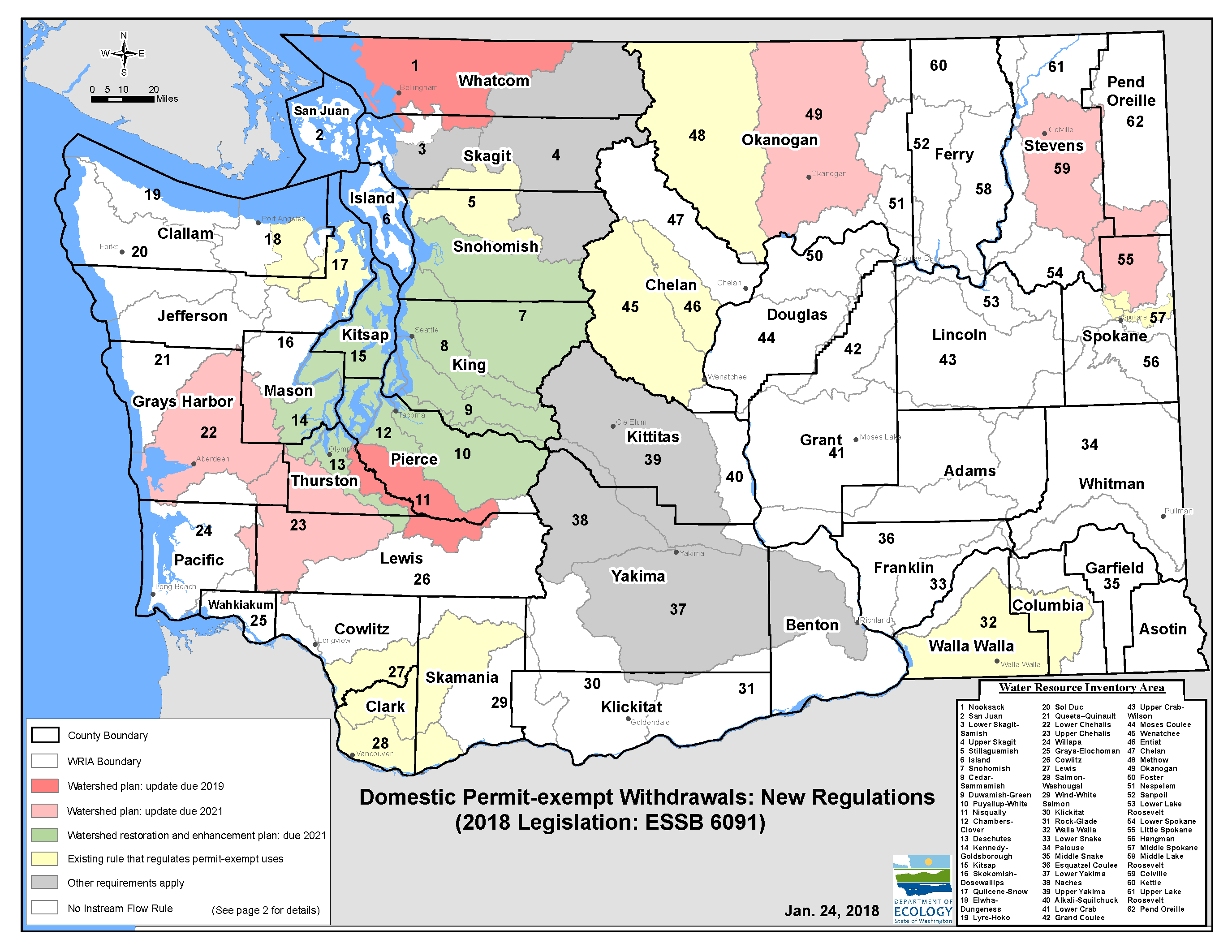

It was a continuous legal fight since 2016 and finally this ruling was overturned through a new law. Engrossed Substitute Senate Bill 6091 was passed on January 18, 2018 and was immediately signed into law the next day by WA Governor, Jay Inslee. This new law helps protect water resources while providing water for families in rural Washington.

What does this new law do? It’s not perfect, but it’s a really good start.

- The law focuses on 15 watersheds that were impacted most by the Hirst decision and establishes standards for residential permit-exempt wells. Now, the cities and counties can go back to some of the old rules and no longer be burdened with having to be an expert in an area they aren’t familiar with.

- The law divides the 15 basins into those that have previously adopted a watershed plan and those that did not. This adds clarity for how decisions are made.

- The law allows counties to rely on our instream flow rules in preparing comprehensive plans and development for water availability. That’s great, because the local jurisdictions just didn’t have the hours in to become the water experts on their own.

- It allows rural residents to have access to water from permit-exempt wells to build a home. All those people in the country just got to live in their homes again or finish building, which is great.

- Retains the current maximum limit of 5,000 gallons per day for permit-exempt domestic water use in watersheds that do not have existing instream flow rules.

- It lays out interim standards that will apply until local committees develop plans that are adopted:

- Allows a maximum of 950 or up to 3,000 gallons per day for domestic use, depending on the watershed they are in.

- Establishes a one-time $500 fee for landowners building a home using a permit-exempt well in certain affected areas.

- Invests $300 million over 15 years in projects that will help fish and stream flows (aka new jobs).

(Learn More: https://ecology.wa.gov/Water-Shorelines/Water-Supply/Water-Rights/Case-Law/Hirst-Decision)

So, after all this… will the local counties or cities change their tune and start issuing building permits again? Eventually, I think they will. Since this is brand new law, it will take a little time for the counties to evaluate how it impacts their decisions and development codes. However, with such an important topic, I believe that most counties are trying to respond as quickly as they can and issue building permits accordingly.

What impact does this have on old wells?

Not much. The law went into effect on January 19, 2018. All wells that were constructed prior to this date were subject to old rules which meant they had to show evidence of adequate water supply. All wells after this date are subject to the new law and new exemptions.

Which watersheds had previously adopted plans and is now subject to the 3,000 gallons per day with drawl? The Nooksack, Nisqually, Lower Chehalis, Upper Chehalis, Okanogan, Little Spokane, and Colville.

Which watersheds do not have a previously adopted plan and are now subject to a maximum withdrawal of 950 gallons per day? The Snohomish, Cedar-Sammamish, Duwamish-Green, Puyallup-White, Chambers-Clover, Deschutes, Kennedy-Goldsborogh, and Kitsap. These eight watersheds are also subject to curtailment during droughts reducing their use to 350 galloons per day for indoor use only.

Why all this talk about water?

First. We all need water and we probably take it for granted. Did you know that in just 2 years, Washington State has dropped from the 3rd best drinking water in the country to the 39th on the list! (source: Washington State Economic Climate Study 2017) If you have not seen the news, the South African city of Cape Town is likely to be the first major city in the world to run out of water. In my opinion, running out of physical water and running out of clean water… kind of the same thing.

Second. We all know someone who has land in a more rural area. There are a number of properties throughout Washington in some of our more rural locations who saw land values sink almost overnight if they didn’t have legally available water in use. That may have just changed. Give me a call to find out what it means.

Want to talk about your land value or how this may impact you?

(206) 293-1005 or jen@hudsoncreg.com any day except Sunday

Market Intelligence Matters.

Tax Update: Victory!!!… Maybe? by Jennifer Hudson

I have never claimed to have a crystal ball, but this is the first time in the last 13 years where I feel the need to send out an update right away.

I have never claimed to have a crystal ball, but this is the first time in the last 13 years where I feel the need to send out an update right away.

If you missed the most recent newsletter, it was about the exciting world of taxes. At the time of writing the last newsletter, the tax plans that were presented by both the House and the Senate proposed increasing the exemption for capital gains on a primary residence from a required 2 of the last 5 years up to 5 of the last 8 years. No one was excited about that in the real estate world, and we started making some calls.

After a little shuffle, we pulled off a WIN! In the final version, the capital gains exemption was left alone and still requires you to live in your property as a primary residence for 2 of the last 5 years in order to be exempt from capital gains. Score!

Bring on the conversion of a primary residence (for only 2 years!) to future rental (for no more than 3 years) game once again! With the market on the upswing, we can build some real equity!

Unfortunately, we lost a different tax benefit instead. You know how we have talked about Home Equity Lines of Credit (HELOC) in the past? Well, the interest on a HELOC used to be tax deductible. Today, it is no longer able to be written off on your taxes.

That makes me a little sad too, but it might be a blessing in disguise.

Maybe the loss of the HELOC tax deduction will actually cause people to pause for a moment before just taking out more debt on their homes. It’s possible, right? Time will tell.

In the meantime, I hope you all had a wonderful New Years and got to spend time with those you care about. I know I did. But now, it’s time to get back to work and invest wisely… and always with an eye on the future.

Looking for projects? Me too. Let’s look together. Call me at (206) 293-1005 or email Jen@HudsonCREG.com for a quick refresher on where the market it at.

Remember… even though prices are higher than they have been, you make money on the purchase, NOT on the sale. Run your numbers carefully before writing checks. Let’s make this a great year!

Market Intelligence Matters.

Knock Knock. Who’s There? The IRS. by Jennifer Hudson

I think many of you are familiar with the whole “2 year tax game.” You know what I’m talking about, right? The one where if you use a property as your primary residence on your tax returns for at least 2 of the previous 5 years, you can avoid capital gains.

How does… I mean DID… this work in real life? Let me show you.

In December 2012 in Everett, the average sales price for a home was $306,761. In December 2014, it was $351,499. In December 2017, it was $472,871… geez! That’s a lot of money in Everett.

In December 2012 in Everett, the average sales price for a home was $306,761. In December 2014, it was $351,499. In December 2017, it was $472,871… geez! That’s a lot of money in Everett.

Let’s say that you purchased your house in 2012 for $306,761 and then sold in in 2014 for $351,499.

(Psst… check out the chart MY HOME: 2012->2014)

If you sold it in 2014 for $351,499, the capital gain tax was magically waived. Well, it’s not magically with elves or anything. It is the tax code, after all.

If you had an extra $15,738 for just living in the home, that seems like a pretty sweet deal.

But, what if you stayed longer and just sold this year in 2017 instead?

(Psst… check out the chart MY HOME: 2012->2017)

Now we’re talking. This looks pretty good right? An extra $127,098 because you were in the upswing of a market. Not bad.

But, that is where most people stop playing the game.

THE EXPANSION SET.

You know how cool card games, like “Cards Against Humanity” or something will get such a great response that they then create expansion sets to keep people coming back?

There is… I mean was…. an expansion set for this tax game too. It’s called the rental property expansion set.

And, this game is one I was playing. Well, still will… but way slower than before, which makes me sad.

Let’s say you bought the home in 2012 and moved out in 2014. You didn’t sell in 2014. Instead you decided to rent the home for 3 years before selling. So, what does that look like? Let’s see.

Ok, but let’s look closer at the investment side.

Rental Income. Let’s say that you rented the house out and after all expenses, maintenance, insurance, property taxes, interest on your mortgage, etc… you were making $1,525 per month income.

$1,525/month x 36 months (or 3 years) = $54,900 in additional income

Depreciation. Now, with an investment property, you also get to depreciate it on your taxes, which reduces your taxable income overall. Let’s say that I was able to depreciate $8,521 per year, or a total of $25,563.

Not to get too complicated, but you’ll have to pay 25% of this back at closing as a depreciation recapture tax to the IRS. Don’t worry about it too much. You were still ahead all the other years. It’s not perfect, just an example.

With this new investment property scenario, what does my income look like now? Let’s see.

(Psst… check out the Expansion Set Chart)

Now we’re talking. You got a house to live in for 2 years which paid you. Plus, you had an investment property for 3 years, which overall paid you too. An extra $201,171 sounds pretty sweet!

NEW TAX PLANS. THINK “5 OF THE LAST 8”.

So what is the change that both the senate and house are talking about?

Well, they want to take the primary residence exemption and expand that to 5 years from the current 2 year period. This means you need to live in your house for a full 5 years on your tax returns before moving.

While there is still not a reconciliation for the new tax plan at the time I am writing this, BOTH the house and senate bills take the primary exemption and extend that requirement to 5 of the last 8 years.

So, in this real-life example above, I would have a surprise $25,420 tax bill (20% tax on the gain of $127,098). If I’m not ready for that, it’s a big surprise.

So, what if I never used the property as a rental and just sold it “early”? What does this new sale look like to someone who bought a house in 2014 instead of 2012? Let’s take a peek.

(Psst… check out the Whoops! Chart)

It’s still great that you get $65,888 after tax on your return. But, that’s still a “surprise” $16,472 tax bill that no one has been accounting for.

The biggest challenge with this scenario is that all the people who have their homes under contract right now but won’t close until 2018 could be left for a bit of a shock come next tax season. In one version of the bill you are protected if you are under contract, the other other… you are just out of luck.

PERSONAL OPINION TIME.

Let’s be real for a moment, shall we?

Issue One – Saving. As a nation, we appear to have a real challenge saving money. I’m not perfect by any means, but I’m trying to learn.

For a lot of people, a “surprise” you owe the IRS an extra $16,472 could really throw off their year and plans. The part I don’t understand is how no one is talking about this.

So yeah, this scares me a little for many of my friends and clients.

You know what else scares me a little bit more?

Issue Two – Understanding Cash at Closing. I feel like a lot of people forget… the dollars you see at closing are NOT the dollars that are taxed by the IRS. The IRS doesn’t care one bit about whether you have a mortgage on a property. That’s your choice.

If you have a home equity line of credit or HELOC against your property that “eats up” all the extra cash at the end, that doesn’t change anything about what you owe the IRS come tax season.

I see a lot of people… and predict that a WHOLE LOT MORE will start taking out home equity lines of credit or HELOCs on their homes in 2018. Why? Because they can.

If you think about it, your lender just sold you a 3.5% mortgage for 30 years. You’re probably not going to give that up. However, I bet that you will go get a line of credit for a slightly higher rate to pull a bunch of money out of your home so you can make improvements or put the kids through college or just go to Disneyland. Whatever it is, a 5.5% HELOC is still cheap and you figure it will be paid back in no time.

Except, what happens when there is an emergency and you really do need to sell your home before the end of 5 years or before the HELOC is paid back? In the scenario above, anyone with a line of credit for more than $65,888 may have to pay money to sell their house instead.

What was previously a break-even scenario could quickly turn into a tax problem if you don’t think ahead.

This potential unseen tax bill combined with future over-leveraged homes scares me too. We did this already. It was called 2006-2009.

Issue Three – Inventory and Housing.

Do you know what concerns me the most right now? It’s the simple fact that this tax plan has many unintended consequences. For example, it may lead to less homes for sale… which will continue to drive our prices up at rates that are not sustainable.

Remember how real estate is about supply & demand? Well, we have a supply issue for the most part. If you haven’t noticed, there are not many homes for sale or rent right now and that is driving up prices both for purchase and prices on rental properties.

As a home owner, I was previously planning on selling 2 homes in 2019. One is my residence and the other is a rental. Now? I don’t plan on selling either of those for the simple issue of taxes that will accompany it. I do pay the IRS every year, but I don’t enjoy it. So, I have now personally added to the inventory shortage problem, which will continue to impact appreciation rates and rental prices. Of course, this makes it less affordable for others no matter which side they are on.

Could I get into the 1031 exchange and start the deferring my taxes? Sure, but it is like heroin (I assume… I’ve never done it). Once you start, it’s hard to stop. The taxes owed just keep rolling over and piling up.

Why do I tell you these things? For starters, I want to try and make people’s lives better. I think you should be aware of what is going on and I think there should be more people talking about true issues and less hype in the world. It drives me crazy that it has become so difficult to find real news.

Second, I think people should do more planning for the future and working just a little bit every day to make that happen. Think of planning for the future like tooth maintenance. Does brushing your teeth once make a difference? No. Does brushing your teeth twice everyday make sure you keep your teeth? Sure does.

I would absolutely love to help you sell your house this next year. Do I think you should? That depends on your life plan and goals moving forward. It’s not about the moment. It’s time to think about the future.

Remember, markets don’t go up forever, but considering the natural disasters, local economy, new jobs, housing, cost of money, and a whole lot more…. I think we have a little while left still before a major shift. So far, this feels like a slow squeeze instead of a bubble, but depending on how you plan, that could be ok.

When you are ready or when you just want to talk, I am here to help.

(206) 293-1005 or jen@hudsoncreg.com any day except Sunday

Market Intelligence Matters. Read Next.

An Obvious Defense, Overlooked By Many. By Jen Hudson

Note: The names have not been changed, as neither party is innocent.

Terry and Diane Visser lived in Blaine, Washington and had a habit of buying homes as investment properties. They bought one of these “fixer-uppers” as an investment back in 2005.

After acquiring the property and beginning their renovations, they realized Continue reading “An Obvious Defense, Overlooked By Many. By Jen Hudson”

A Crazy Little Thing Called… FIRPTA. By Jen Hudson

You’re telling me there is a chance that the buyer pays the seller’s taxes??? How is that??? Continue reading “A Crazy Little Thing Called… FIRPTA. By Jen Hudson”

New Tax Break Could Boost Sales in 2016. By Jen Hudson

Thanks to a tax break in FIRPTA (Foreign Investment in Real Property Tax Act), foreign investors could double down on their US real estate frenzy in 2016. How, you ask?… Continue reading “New Tax Break Could Boost Sales in 2016. By Jen Hudson”

Straight Talk About “Forgiveness.” No, not the kind of forgiveness at church. I mean the tax burden kind.

The following is taken (well… almost) directly from Ed McFerran, McFerran Law, P.S. (253) 284-3838 or www.mcferranlaw.com. He knows a lot of stuff.

First, you’re probably thinking to yourself… “Jen, we’re waaay past this whole recession thing. Why are you talking about debt forgiveness? Continue reading “Straight Talk About “Forgiveness.” No, not the kind of forgiveness at church. I mean the tax burden kind.”

How To Remove a Deed of Trust… Legally. By Jen Hudson

Legally? So you mean there are illegal ways?

Probably. That’s not the type of business I’m in though.

Continue reading “How To Remove a Deed of Trust… Legally. By Jen Hudson”