There is no such thing as a “no-cost” loan. But these options may help.

It’s Time to Raise the Bar. by Jen Hudson

Let me translate the title for our younger crowd… #RaiseTheBar… of your financial fitness, that is.

We recently posted an article about Humans versus Robots. If you missed it, you can read it here.

Following this, we received a very kind note from our good friend and longtime lender, Tom Lasswell.

Tom was gracious enough to expand on our story and pointed out some things that bare repeating.

“I appreciated reading your most recent report…. Technology and how that is impacting Real Estate and Lending…

Too many financial disciplines are needed to work together for an individual or family to even have a basic strategy, let alone a great one. With so many variables for any individual or family, many of the attorneys, financial advisors, CPAs, and Bankers don’t even understand how their service area impacts another, and vice versa.”

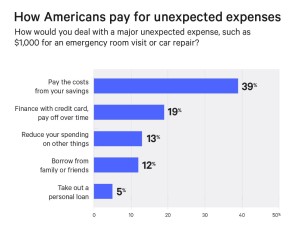

Based on a recent report published by CNBC (and released by Bankrate), only 39% of Americans could cover an unexpected $1000 emergency from their own funds. In case you are doing the math, that translates to 61% of Americans do not have enough cash or money in the bank to pay a $1000 emergency.

That. Is. Scary. Especially when most emergencies cost a lot more than $1000… at least from what I have seen.

That. Is. Scary. Especially when most emergencies cost a lot more than $1000… at least from what I have seen.

He continues with “the industries have dumbed down their disciplines to compete. Yet what I see today is Sales people Selling and Telling, when they should be Caring and Consulting. Many do not have the education and expertise to truly guide their clients in the best manner possible.”

Is it in anyone’s best interest for us to sit back and ignore the problems that these automated and “streamlined” systems are creating? I don’t think so. Where has common sense gone?

Tom states “there are approximately 216 combinations of residential mortgage and insurance strategies.”

That is a lot of combinations for a single mortgage or insurance or financial advisor to understand. But, isn’t that their job? Shouldn’t you be able to have a qualified professional discuss the pros and cons with you personally based on your unique situation? Yes, it takes work to understand all those details and be able to educate someone on them. But…. That is what I thought a professional was!

With this ongoing shift in our world to a more automated and “intuitive” system, we need to be careful. If most loan advisors do not really understand how rates work, then how can you expect them to guide the technology company to create a program that works in their client’s best interest?

Next time you run into a “professional”… or professional hack, that is… ask them what is the difference between a stock and a bond? Or, the difference between an annuity or life insurance policy? How about the difference between a will and a trust? Careful though, all of these questions will also require you to then ask your CPAs how all the tax implications work. I hope you have a good CPA too!

Tom warns us that we need to be aware of entire industries that are trying so hard to compete on price, that they have overlooked value completely. If you are working with a professional who lacks the understanding behind their industry and service, then maybe you should keep searching for a real professional instead. If you have questions, the answer should NEVER be “let’s not discuss too many options, as that elicits too many questions and crates too many headaches for our company.” Of course, they don’t state that directly… but you get the feeling a lot of times that is what they want to say, right?

When you need a real professional for your lending needs, you should give our friend Tom Lasswell with New American Funding a call at (206) 817-5532. He’s been in the business for 35 years and knows more than just a thing or two.

And, when you want a team of professionals who truly understand the real estate market and all the related and moving components, you can reach us directly any day except Sunday.

Duane Petzoldt (425) 239-1780 or duane@hudsoncreg.com

Jen Hudson (206) 293-1005 or jen@hudsoncreg.com

Your life decisions shouldn’t be made by a robot, and certainly not a robot that is still in the beta phase. Let’s all come together and force these companies to raise the bar when it comes to their automated technology and how they train the people who are supposed to be helping you.

Cheers!

Jen Hudson & Duane Petzoldt

Humans Are Underrated. by Jen Hudson

How Technology Needs A Better Approach For Sustainable Success.

Let’s talk about the elephant in the room. You know, the one where robots take over the jobs of humans. Today, let’s talk about the jobs in real estate and lending.

Or, to be more specific, the disruption that is forcing changes across the industry.

Hold on, that sounds technical.

It is, but not really. Let’s use common sense.

Disruption: A radical change in an industry or business strategy, especially involving the introduction of a new product or service that creates a new market.

Disruption is also known as “forget about the old way of doing things, it no longer exists”. This new way involves something faster and automated, which typically means cheaper. But remember, as everyone races to the bottom with their giant Amazon companies, the floor doesn’t stop at zero. There are negative numbers too, meaning many companies are losing money with the hope that one day they grab enough low-paying customers to compensate for the overhead.

Do you want another scary realization? The next time you sign up for something that is “free”… if you aren’t the paying customer, then that means you are the product being sold. Yup. Welcome to technology.

Editors Note: We don’t sell your name or data, even though this is free. Thanks for reading. Cheers!

Both the real estate and lending industry have been ripe for disruption for decades. We’ve talked about it for years, but it is happening before our eyes. Today.

In a lot of ways, I’m super excited about the new innovations that are coming to light. In other ways, it scares the bejesus out of me for the consumers who just don’t know any better and don’t enough know enough to ask.

Before we dive into what robots and artificial intelligence are doing, let’s look at where companies are heading with their business models.

Before we dive into what robots and artificial intelligence are doing, let’s look at where companies are heading with their business models.

There have been countless news stories and opinion columnists citing statistics and reports on start-ups poised to shake things up. Admittedly, the numbers are impressive. Investor funding runs well into nine figures for the two largest direct homebuyers, Opendoor ($320 million) and OfferPad ($260 million).

As entrepreneurs and investors have continued to gravitate towards the various opportunities offered within real estate, the Real Estate Tech ecosystem has grown in both size and scope. Since 2012, Real Estate Tech companies have received over $6 billion in funding, with companies raising $2.6 billion in venture capital in 2016 alone, a substantial increase from the $1.9 billion reported in 2015. With over 100 real estate focused startups receiving early stage funding in 2016 and later stage tech enabled real estate companies like Compass (raised $450 million in early December 2017) and Redfin ($138 million IPO in July 2017) raising substantial amounts of capital, the sector has undoubtedly piqued the interest of consumers, investors, and industry players alike. Not to mention Zillow.

What are these companies doing that makes investors so excited they are willing to pump in hundreds of millions of dollars into them? They are creating mega-tech one-stop-shop companies that are meant to take over your life.

First up, let us look at Rocket Mortgage.

I’m sure you have heard of Rocket Mortgage by now. Rocket Mortgage is owned by Quicken Loans, and had it’s coming out party during the 2016 Super Bowl Ads. According to housing wire, Quicken Loans was #1 in 2017 by transaction volume and looks to be heading to the number #1 spot for 2018 as well. Quicken did have true innovation when it comes to Rocket Mortgage, and they were rewarded with the top spot in the country for lenders by both the highest number of transactions and largest volume of mortgages.

(Full disclosure: I’m not a Quicken Loan fan, but I can still respect some of the technology they have created and implemented into their company.)

So, what did Quicken Loans do that is different than many lenders? A couple things.

- Ease of Use. They turned what used to be a cumbersome process of applying for a mortgage to a thing you can do from your phone in your own time, saving consumers a lot of the hassle. They took a process that would typically take 30-60 days and crunched it down to roughly 10 days by automating most of the process into an algorithm. I think they say something about approving (or denying) your loan in as little as 8 minutes. The appraisals delay the process to 10 days, since those are still are done by humans.

- Centralized Data. They linked almost everything you do online into a single portal to help speed the process. Forget the days of having to comb through paper bank statements and email those to your lender or drop them off. Quicken links their portal into your bank directly to access your bank statements, current available funds, and even history of deposits. Some employers now verify your employment status through their app, and no longer require people to talk with managers. It’s not 100% online, but it is sure close to it, and probably will be in the very near future.

- One-Stop-Shop. The Quicken Loans family looks a lot like it’s trying to be the Amazon of lending. Did you know, Quicken owns approximately 81 other companies (not including their additional “partnerships”) with everything from Financial Services, Financial Tech Companies, Online Technology Companies, Home Furnishings, Investment Services, Architect Services, Accounting, Billing & Receivables, Website & Design, Gaming, Hotels, Casinos, Home Flipping and Renovations, Online Schools, Security Services, Property Management, Real Estate Sales, Multiple Venture Capital Firms, Self Driving Cars, and countless companies all aimed at online technology, web presence, and improving efficiency for business.

Hey, that’s just one company. You can’t use one company as an example of where the whole industry is heading!

That’s true.

Let’s look at the nation’s number two lender. LoanDepot. LoanDepot launched mello Home earlier this year, which is a service that connects buyer clients to their agents. Sounds like another “one stop shop” approach, like Amazon. And, it is. I won’t make you sit through the list twice, but it’s pretty much the same thing with a variety of separate companies all brought together under one roof.

What about number 3, 4, 5, etc? Yup. They are all attempting to create a one-stop-shop for services with the hope of having you spend less time shopping services between companies and more time just writing them one big fat check instead of a bunch of small ones.

Ok, so what about robots and artificial intelligence taking over human jobs? Should traditional brokerages feel threatened? Maybe. But, probably not.

While these technological advances are meant to eliminate the human element, humans are still necessary in a lot of ways. Elon Musk (PayPal, Space-X, Tesla, SolarCity, and The Boring Company) will tell you that humans are underrated and that he brought people back into Tesla to help smooth the process and speed things back up in his production line. His robots got too unwieldy and slowed things down!

So if robots alone are too cumbersome and humans alone are too slow, what is the answer?

A human-machine symbiosis. That is what we should be talking about. Creating robots to enhance human services, not to replace them.

I’m sure you have heard the opinion that real estate agents and lenders will soon be replaced by technology. However, I tend to think that the agent-centric model has staying power, though it will look a bit different in the future.

In my opinion, the new technology (whether you mean software, applications, block-chain, robots, etc) should work to accelerate the closing process and smooth out some of the hurdles. Loans could become faster. Property information may be easier to find. Title issues could be quicker to address or monitor. But at the end of the day, it still involves people.

While this massive collection of data and introduction of search portals has increased the amount of information available and speed to get to it, it has not provided anyone with the context necessary to make a decision. Media company models focus on optimizing for page-views and clicks, yet fail to support crucial channels of information exchange between agents and clients. This is proven by the increased demand for agents over the last two decades even with the introduction of platforms such as Trulia and Zillow.

Why do I think that real estate and lending professionals will remain essential?

Simply because humans are better at some things than robots.

For example:

- EMOTIONS. First, buying a home is typically the largest financial transaction in a person’s life. It is highly emotional, and occurs infrequently. Consumers want practical, cultural, and emotional guidance as they navigate this decision. Why can I stand here and say without a doubt that people want guidance in this area, despite the available online information? Because we have already created a new industry of “consultants” for online services. For example, you hire a person to manage your SEO, a person creates the content for social media, and you can even hire a consultant to improve your odds with online dating! Seems a little backwards with the “online”, doesn’t it? This is want people want, so I’ll take it as a glimmer of hope.

- QUALITY OF CARE. Second, real estate agents and lenders perform many functions which software can only partially eliminate. Certain tasks should and will be automated, such as scheduling and paperwork. We recently had a lender in Washington State who had their loan documents signed with a notary through a video-conference session. But, technology doesn’t allow for coordinating with all the other parties, staying up on local policy changes, politics, etc. The dirty word of “closing” a sale still requires a human touch because it requires you to consider all the options around the property aspects, your lifestyle choices, and your desires for the future.

- Hyper-Geographic Expertise. Third, as much as we may not want to admit, agents remain the most cost-effective method for sellers to find buyers. Hyper-geographic expertise allows agents to offer buyers a smooth process to closing and access in a private real estate marketplace. You are still dealing with people’s homes and businesses. While automated brokerages seem elegant and low-touch, when you factor in the human pieces and the various conversion points necessary to help a person buy a home (marketing, filtering real buyers from the tire kickers, protecting clients from being taken advantage of by vultures, and mid-escrow re-negotiations when something goes wrong, etc.), these programmed platforms are far less efficient and likely lead to failure when left on their own. Although humans are not scalable, they are a fundamentally cheap mode of customer acquisition and the best assurance your transaction makes it to closing.

- Relationships. Finally, real estate may be about properties, but it is ultimately an industry that centers around people. Technology can support those relationships, but it will not replace them.

Given these observations, I believe that a successful real estate platform will augment agents with data and tools to accelerate their business and serve their clients better.

Some areas where I hope to see great improvements are:

- Embrace Technology: Whether it’s new ways to streamline transactions (DocuSign, zipLogix, virtual notaries, etc.) or better ways to market properties (virtual staging, virtual tours, etc), there are countless ways to make the customer interaction more seamless.

- Targeted marketing: Most real estate marketing takes the form of untargeted spray and pray tactics. This is true even with Facebook ads (don’t get me started!). What we aim for enables intelligent, personalized agent-to-agent marketing by matching a buyer’s demand with available inventory, or matching it with potential inventory through something like Zillow’s Make Me Move concept.

- Property pricing: At present, there is no way to “guarantee” what a property is worth. Zillow doesn’t have the answer either and will pay you one million dollars to help them figure it out. Pricing is both art and science and requires a lot of personal analysis, local knowledge, and old-fashioned boots on the ground approach, day-in and day-out, in order to be competent in the game of ever-changing market values.

- Streamlined Process: There is still a lot of manual labor involved with buying a property. Lenders, such as Quicken Loans, realized this and have tried to streamline as much as they can with their app. Maybe one day, the process will be streamlined across the board and all you need to do is schedule the closing date and then automatically your utilities, loan, insurance, and more are all pro-rated and magically accounts are opened and closed as needed. That day might be closer than we think.

- Changing Ideals: With Wi-Fi capabilities and/or cell-phone coverage almost everywhere (even a wi-fi hotspot in my truck!) people are no longer tied to an office. You can browse properties or sign contracts with the swipe of your finger while sitting at a Little League game or out on the beach.

While the technology to find data or accomplish transactions has improved, the basis for decision making or in-depth understanding about the process has not progressed forward, and in many ways I feel it is taking leaps backwards. Maybe there will be a change in direction and people will begin to expect a higher level of competency with all this technology we are creating. The data is there. We just need to teach people how to use it!

Moving forward, let’s focus on integrating humans and robots, not replacing humans with robots.

If we are going to see any real advances in real estate technology, it will be to improve the agents or lenders ability to educate their clients by interpreting and telling stories with data. Buyers and Sellers will want someone who can tell narratives about past work in a neighborhood, draw attention to unusual features of a property, and help frame the price of a new home in terms of financial and demographic trends. Real estate agents and lenders with sophisticated tools will likely perform these functions better than automated brokerages for decades to come, but it takes work. Don’t forget that on the other side of that post is a real live person. Be nice.

In the words of Elon Musk (ok, it was a tweet), “Humans Are Underrated”. Finding applications that help humans become more efficient is a better bet than creating applications to replace humans completely. In real estate and lending, there will always be a demand for humans who are experts in their field and provide consumers with more meaningful experiences.

Need help getting started? We are happy to point you in the right direction with data that can be trusted and help you make connections with the people you need to know.

Jen Hudson | (206) 293-1005 | jen@hudsoncreg.com

Duane Petzoldt | (425) 239-1780 | duane@hudsoncreg.com

How does housing relate to the economy? We make it simple. by Jen Hudson

STATE OF THE MARKET, 1ST QUARTER 2018

We believe that the housing market is a lot more than just homes. This graphic (below) is oversimplified, but just think about all the interlocking pieces involved for our world to function.

Now with this big picture view in mind, let’s talk about what is going on in Washington State today.

Now with this big picture view in mind, let’s talk about what is going on in Washington State today.

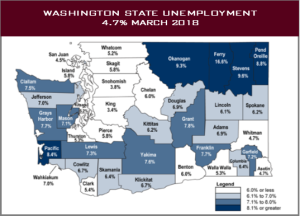

The Washington State economy added 96,900 new jobs over the past 12 months, representing an annual growth rate of 2.9%—still solidly above the national rate of 1.5%. Most of the employment gains were in the private sector, which rose by 3.4%. The public sector saw a more modest increase of 1.6%.

The strongest growth was in the Education & Health Services and Retail sectors, which added 17,300 and 16,700 jobs, respectively. The Construction sector added 10,900 new positions over the past 12 months. 10,900 jobs in Construction is a start, but let’s face it… we need a lot more than that to catch up with our housing demands.

Even with this solid increase in jobs, the state unemployment rate held steady at 4.7%—a figure that has not moved since September of last year. Remember, the unemployment rate only counts people who are looking for jobs in the workforce, not people who can’t work or who are sitting on the sidelines.

We expect the Washington State economy to continue adding jobs in 2018, but not at the same rate as last year. Why? A couple reasons. One, employers only hire as many people as they need to run a company. If employers are already fully staffed, then their business demands need to increase before making new jobs. Plus, you can’t have new jobs without people. If people are not able to work, or choose not to work, then you can’t hire them. It’s that simple. That said, we will still outperform the nation as a whole when it comes to job creation, as we have a lot of stable and “needs-based” industries here, such as Health Care, Aerospace, Education, and Transportation.

Where did we lose jobs? Manufacturing. Our Manufacturing sector has lost 5,700 jobs this past year, with another loss of 3,300 projected.

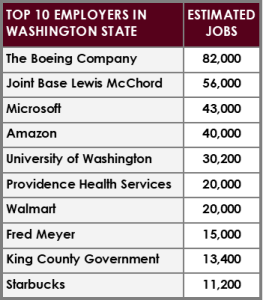

Where else are we paying attention? Aerospace. There is some concern that President Trump’s steel and aluminum tariffs could hurt manufacturers such as Boeing. While much of Boeing’s material is sourced domestically, many of their orders come from China. If China decides to retaliate, they could easily shift their orders over to Airbus, which would hurt our local economy. On a good note, there is a growing demand for cargo planes, which means the 767 line in Everett is expected to increase, along with 737s and 787s.

This increase in cargo planes also supports what we are seeing down in the Ports. The container volume (you know, the giant metal containers that go from ships to trains to trucks to stores) was up 6% in February, and our breakbulk volume (meaning things that need to be loaded individually, like oil in containers or apples in crates) was up almost 30%. The one shipment that has been down consistently? Auto volume, which was down 8% in February.

What other major companies drive our local economy besides Boeing and the Ports?

Amazon. They currently have 8.1 million square feet of office space, which is expected to soar to 12 million square feet within the next 5 years. Amazon’s search for H2 has concerns for slowed hiring locally, but regardless they are still one of our heavy hitters when it comes to employment. Microsoft is also talking about expanding their Redmond Campus, which means ultimately renovating 6.7 million square feet and building another 2.5 million square feet by the end of 2020. Other major drivers in our local economy for office space are a mix of both old and new tech companies, including Cisco, Apple, eBay, AirBNB, Uber, Snap, Alibaba, Tableau, Valve, and Wave Broadband.

Amazon. They currently have 8.1 million square feet of office space, which is expected to soar to 12 million square feet within the next 5 years. Amazon’s search for H2 has concerns for slowed hiring locally, but regardless they are still one of our heavy hitters when it comes to employment. Microsoft is also talking about expanding their Redmond Campus, which means ultimately renovating 6.7 million square feet and building another 2.5 million square feet by the end of 2020. Other major drivers in our local economy for office space are a mix of both old and new tech companies, including Cisco, Apple, eBay, AirBNB, Uber, Snap, Alibaba, Tableau, Valve, and Wave Broadband.

On the slower side we have retailers. We are going to lose some major stores this year both locally and nationally due to closures, including Macy’s, Sears, Kmart, Toys R Us, and Babies R Us. Despite this, there are still new retail stores and centers under construction, with others moving toward more of a mixed-use design.

Home Sales Activity: Western Washington

- There were 14,961 home sales during the first quarter of 2018. This is a drop of 5.4% over the same period in 2017.

- Listing inventory in the quarter was down by 17.6% when compared to the first quarter of 2017, but pending home sales rose by 2.6% over the same period, suggesting that closings in the second quarter should be fairly robust.

- The takeaway from this data is that the lack of supply continues to put a damper on sales. We also believe that the rise in interest rates in the final quarter of 2017 likely pulled sales forward, leading to a drop in sales in the first quarter of 2018.

- Anyone expecting to see a rapid rise in the number of homes for sale in 2018 will likely be disappointed. New construction permit activity—a leading indicator—remains well below historic levels and this will continue to put increasing pressure on the resale home market.

Annual Changes in Home Prices: Western Washington

- With ongoing limited inventory, it’s not surprising that the growth in home prices continues to trend well above the long-term average. Year-over-year, average prices rose 14.4% to $468,312.

- Economic vitality in the region is leading to robust housing demand that exceeds supply. Given the limited number of new construction homes, there will continue to be pressure on the resale market. As a result, we believe home prices will continue to rise at above-average rates in the coming year.

- Mortgage rates continued to rise during first quarter, and are expected to increase modestly in the coming months. By the end of the year interest rates will likely land around 4.9% +/-, which should take some of the steam out of price growth. This is actually a good thing and should help address the challenges we face with housing affordability—especially in markets near the major job centers.

While the housing market is great today, please keep in mind that everything cycles. Will home values drop tomorrow? Probably not. Keep an eye on interest rates and your timing in the market if you want to make any moves in the future. Need help trying to predict the future? Give us a call or email to stay ahead of the trends.

Jen Hudson (206) 293-1005 and Duane Petzoldt (425) 239-1780

Commercial RE Appraisal Changes

Did you know? On April 9, 2018, the FDIC changed their rules. Per the federal agencies, commercial real estate transactions below $500,000 will no longer be required to have an appraisal.

Remember, just because the FDIC doesn’t require something… that doesn’t mean your local lender or bank won’t.

Want to read the full rules? Check them out here.

If you need help getting prepared for your next investment or business purchase, give us a call.

Jen Hudson

(206) 293-1005 or jen@hudsoncreg.com

Duane Petzoldt

(425) 239-1780 or duane@hudsoncreg.com

The Problem with Snapshots. by Jen Hudson

If you know me, then you know that I care about the facts. I don’t mean facts in the sense that “fake news” is overtaking our world. That’s for a different discussion. Just because you can find 6 friends on Facebook to agree with you, doesn’t mean you get to change the truth.

No, I mean the issue that I have anytime someone says something like “we have a shortage of housing!”.

Let’s look at some true facts and figures for our area and talk about how markets work in real life.

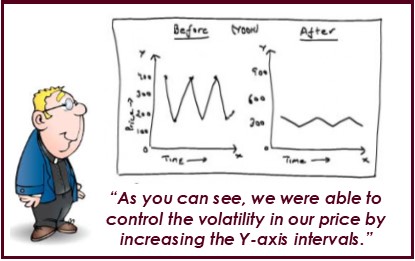

The Typical Graph

Here is the typical “chart” that I see floating around real estate offices or online. I borrowed this one from Trulia. Let’s look past the part where it is now March, and yet they are showing me data between May-August from some unknown year.

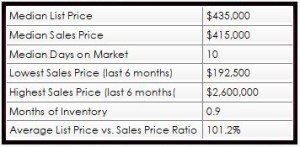

Or sometimes we see information like this. I stole this data from Redfin and would like to assume it’s current.

| Median List Price | $875k |

| Median Sales Price | $700k |

| Average Sale/List Price | 107.4% |

| Average Number of Offers | 4.4 |

| Median List Price/Square Foot | $471/sf |

So, these are great and everything… but what can you learn from them?

I will tell you. Trulia’s graph makes you think prices are skyrocketing and creating a bubble, right? Redfin makes you think everything sells with multiple offers and prices jump leaps and bounds, no matter what price you put on your home.

But, do you want to know a secret? Pricing is really all about the market, and the market always comes back to economics 101. Supply versus Demand.

Yes, it is really that simple.

But what numbers do you need to know to understand what is happening in the real estate market?

Let’s dig a little further in our real-life, local example, and show you what you are missing.

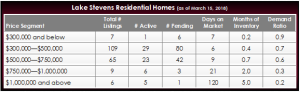

Let’s look at Lake Stevens to start. What would you think if you saw the following information about Lake Stevens real estate?

Based on this, it appears that homes are flying off the shelf in Lake Stevens. If I’m a seller, I expect that magically all I need to do is list my house and then about a week later, it will be sold. As a seller, I’m also pretty sure that my house must be better than the ones that sell for $415,000, so it will of course sell faster.

Maybe. But, maybe not. Have you walked through what sells for $415,000 lately? It’s different than what sold for $415,000 a couple years ago.

This is clearly not enough information. Let’s dig further.

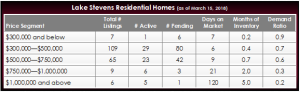

Now what do you think when you see the information expanded into a little more detail?

This is interesting too. It appears that there is an entire range of homes selling in just 10 days. I could sell my trailer in the woods or my waterfront estate in roughly a week and for a little more than I ask for! Clearly everything is selling for 100.01%!

This is better, but it is still not ideal.

Now, let’s break up our information a little bit more and really dive into the activity in each price segment.

Pro-tip: Pricing Segments are keys to understanding market movement.

Alright. Now we are talking. This information is useful.Side bar: These are wide price segments shown for discussion purposes only. In real life, I will break them down even further into ranges that would encompass your specific property and location, to get a true gauge of demand and activity. For example, if your home is worth $450,000, then we will probably look between $400,000-$500,000, since that may be the range a typical buyer for your property looks at.

Let’s point out a couple things that may or may not be obvious.

Price Segments. By segmenting everything into targeted price points, I can now see that there are 109 homes in Lake Stevens priced between $300-$500k and an additional 65 homes priced between $500-$750k. I can also see that there are far fewer homes on both the lower end below $300k and the upper end above $750k, or 7 and 15 homes respectively.

I would not have known this with a general price statement, so now you can see where the competing homes for sale are.

Days on Market. Days on market is great, but only when it is used in your targeted price segment. Buyers want to know how quickly they will need to make and offer. Sellers want to know how long they can expect before they need to pack up and move.

Remember that Days on Market is not a set number. Homes will always sell for what the market is. If it is priced lower, it could mean bidding wars and multiple offers immediately. If a property is priced too high, it will sit for a little longer.

Activity & Demand. This is cool too. Do you notice how there are currently 80 buyers between $300-$500k and another 42 buyers between $500-$750k, yet there are only a handful for the lower and upper ends? It’s something to consider, whether buying or selling. You need to position yourself correctly and understand where you are within each price segment.

Months of Inventory. We have all heard of buyer’s markets and seller’s markets. But, what is that about? First, you need to understand that all statements about months of inventory make a lot of assumptions.

They essentially say… “Assuming there are no additional listings that come on the market, no additional properties that go off the market, and a steady flow of buyers who will consistently continue to buy homes at the same rate they have over the past 6 months (or 12 months or whatever number you are using for data), then it will take XX number of months to sell the rest of the available homes.”

Is that a real life scenario? No.

I do think the months of inventory is a good gauge to look at and keep in mind when trying to price your property strategically, but it is also important to recognize there are other things at play beyond our control. Things like the season, weather, interest rates, local economy, community development (or lack of), employers, global economic forces, and more.

Demand Ratio. The demand ratio is something I made up, but it gives us a very realistic perspective of where the buyers are, and in a very common sense way. Let’s define the demand ratio as number of pending homes divided by number of homes listed on the market (active plus pending).

For example, if there are 80 buyers under contract (pending) and 109 sellers wanting to sell (80 pending plus 29 active), they have a demand ratio of 0.7 (80 divided by 109). This is a good strong number if I’m a seller and means there is a lot of competition if I’m a buyer. What we have just figured out is that for every home on the market, there are 0.7 buyers looking for it.

However, if there is only 1 buyer under contract above $1 million, and 5 homes left to choose from over (means 1 pending plus 5 active = 6), then my demand ratio has dropped significantly to 0.17. Now, the ball is in the buyer’s court with a plenty of options to consider and low competition from other buyers.

Some obvious things to point out:

- If we are talking about a demand ratio and there are no buyers in that price range and area… then the demand is zero (0). If you are a buyer, this is a wonderful time to shop since you are your only competition. If you are a seller, then you had better get realistic about your price to try and attract all potential buyers. Period.

- If all the homes on the market are under contract or pending, then your demand ratio is one (1). In that case, if you are a buyer then you will need to be ready to pounce immediately on the next opportunity that comes along.

If you are a seller, you still can’t be greedy. While it is tempting to want to test the waters a little, remember than an overpriced property is still overpriced.

Sales Price versus List Price Ratios.

You may have noticed that I did not include any information about what the ratio for sales price versus list price.

Here’s my two cents and opinion on the topic.

I think agents need to know what their sales price versus list price ratio is, but I think this number is misinterpreted. With the correct exposure and negotiating for any property, a professional agent will be able to get you the best of what the market will bear.

I am sure you have talked with someone or seen statistics where a home received 15 offers and sold for 112% of it’s list price. Many people use it almost like bragging rights today… but this isn’t something they would brag about if they understood what happened.

Multiple offers and a bidding war might be great in most seller’s minds, but do you know what I think? I think that whoever the agent was didn’t understand their market at all and was a disservice to their client instead.

Consider the numbers. If you are the seller in Lake Stevens with a $415,000 home… that means your agent almost lost you 12% or $49,800 in your sale. Something to think about anyway.

For me personally, as a Seller’s agent my list to sales price ratio is 101.7% based on the last year. This indicates I am a little more aggressive for pricing and pulled in a couple buyers to use against each other to bid the property up. In this market this competitive strategy works, but it depends on your price segment and demand ratios.

As a Buyer’s agent, my list to sales price ratio is 95.5%, indicating I find deals for my clients and know how to negotiate them down to favorable terms.

The Big Secret About Obvious Information

Here is one last thing to keep in mind. In many circumstances like we have today, this is the optimal time to “move-up” into your next almost dream house. Depending on your location and the market conditions, you could easily be in a “seller’s market” as you sell your $450k home and quickly shift into your next move into a slower moving balanced or buyer’s market, as you purchase your new $700k home. The different segments within the market, plus the equity you may have earned in your current home could start to pay off much more quickly than you realize and ultimately get your closer to your dreams.

The next time you see a generic graph or table with basic information, take a moment to consider what is really going on in the market. Of course, if you need help and want real answers from a true professional, then I’m easy to find most any day except Sundays.

I hope this helps you with your plans toward the big picture. My partner Duane and I would be honored to help you with your next move or investment… since it is an amazing time to take advantage of what other people don’t know or just can’t see. You can call Jen at (206) 293-1005 or Duane at (425) 239-1780.

Cheers!

Jen Hudson & Duane Petzoldt

Water Rights. A Pretty Dry Topic. by Jennifer Hudson

In case you missed it, Washington State had an emergency for the last two years… and it was over who got to make decisions about water.

What am I talking about?

Let’s go back to the beginning.

At first glance, water rights or water claims don’t seem like they should be that complicated. It’s just water. We have lots of water.

But, then you start to think about it for a moment… and immediately confusion sets in.

I’ll try to simplify.

In Washington State, we have the Department of Ecology. Call them the DOE, since it looks cool. The DOE are the “big dogs” when it comes to all things water.

While I can’t explain how they reach their conclusions, the DOE looks at where water flows, how much we have, what it is used for, and so on.

Now… my overly simplified version of water rights or water claims.

The Department of Ecology says that water rights belong to the state and that an individual or group can be granted “rights” to use a certain amount of water, for a specific purpose, and in a specific place.

They care a lot about both fish and people. So, what does the DOE look at?

Imagine that it rains in your front yard. The DOE might be able to tell you not only where those rain drops go after they soak into the ground, but also how long it takes those drops to get there. Does it take 1 month for the drops to make it to the pond, and then a year to make it to a stream, and then 20 years to make it to the ocean? Maybe.

Does the DOE put little individual trackers on rain drops to see exactly where they scatter too? Probably not.

However, the DOE is likely the most reliable source for predicting exactly where water goes over time than anyone else in the State. So, they get a lot of points for that.

If you wanted to build a house, or a shopping center, or a ranch, or even a farm, it is likely that the DOE is involved. After all, they get to determine if there is enough water to feed your family or your herd of cattle or even to water your tomatoes.

Who actually uses water from the ground?

I hope you paused just for a moment with that question. Everyone does. Let’s not get off topic. Not everyone know how water gets to your faucet.

How are water rights decided?

There are over 230,000 active water right certificates, permits, applications, and claims that the DOE manages to make sure the state can meet all the water supply needs.

With so many people needing water, and no actual guarantee there will be enough, the DOE uses a system called “the doctrine of prior appropriation.” This is fancy talk for “first in time, first in right.” Essentially, if there is a water shortage, then the senior water rights get their water first and the junior (meaning younger) rights can be slowed or taken away.

What does it take to issue a water right permit?

They have a four-part test, to make it simple.

- Water must be both physically and legally available. Not only does there need to be actual water there, but there needs to be enough water after everyone else ahead of you in line has a drink from the faucet.

- Water must be used beneficially… no wasting please.

- Water use must be in the public’s interest. For example, in the Gremlins movie, spilling water on Gizmo is a bad idea because it spawns Gremlins which are evil little monsters who are not in the public’s best interest. You probably don’t get a water right permit for Gremlins.

- Water use must not impair another existing use. No stealing. Pretty simple.

Wait. There’s a catch. The continuous use rule.

Even if you are the oldest water right at the very beginning of the line, if you stop using your water for 5 consecutive years, then you lose your spot in line and the state takes their rights back.

How does the state know whether or not you are using water?

That part is easier than you think.

In many parts of Eastern Washington, think of things like satellite images or even google streets. If your property is the only brown one surrounded by a sea of green, then odds are you aren’t watering your plants. The same is true in the reverse. If you are the only green field among a bunch of brown ones, then you are probably using water when you shouldn’t. Neighbors and local departments tend to watch these things.

Now for the Definitions.

There are a few terms you hear around water rights. A water right permit is just that. It is a permit to develop a water right.

- Permit – A Water Right Permit is an authorization to use a specific amount of water in a specific place, during a certain season, and with a specific purpose. Whew!

- Certificate – A Water Certificate documents a “perfected” water right put to it’s full use and recorded in appropriate county on the deed for that property.

- Adjudicated Certificate – A Certificate that has not only been in use and recorded, but also validated by a local superior court… which means someone questioned it earlier. Adjudication is a special court process that determines if something is legally valid. So, adjudicated certificates are pretty solid.

- Claim – A water claim is an old water right that so old it came before the current water permitting system (prior to 1917 for surface water and prior to 1945 for ground water). If anyone questions these claims, then the only way they can be confirmed is through adjudication.

- Trust Water Right – This is the safety button so you don’t lose your place in line. If you know that you will not use your water rights for a while, but you don’t want them to be taken away, you can place your water right into the Trust Water Rights Program to protect it from relinquishment due to non-use.

While all these names are all different, they provide similar benefits… such as access to water.

This leads us to the simple question.

Do you need a water right? I’m glad you asked.

As with most things real estate… it depends.

It is important to realize there is a difference in the rules between water that is above ground and water that is below.

Surface water is the water above ground. Think water from streams, rivers, lakes, springs. If you ever want to use surface water in any way at all… you will need a water right to do so.

Ground water is a little different. Think drilling wells, tapping into aquafers, joining a community water system, or even a public utility district. If we are talking about using ground water, there are some exemptions that let you just use the water when you needed it from below the surface.

Side bar: We were told for many years that surface water and ground water are different… but if all the water from the surface (rainfall to steams to rivers, etc) eventually runs below the ground to the aquifers… then why are there different rules? I don’t have the answer. Just a lot of questions.

Those exemptions are:

- A single user or group of domestic uses that use less than 5,000 gallons per day;

- Industrial uses of less than 5,000 gallons per day;

- Irrigation and non-commercial uses of less than one-half acre of lawn or garden; or

- Stock water… for things like cows.

As a point of reference, most households use around 200 gallons per day. Some mature trees use more than that. Some use far less.

Previously, we had a system for who got to use water. Let’s just sum up the issue of who decides whether you can use water varies depending on the location you are in. The DOE had rules relating to seniority of water rights, watershed plans, growth areas, etc. The goal is protect water quality, availability, and all things that surround it.

If you were joining a community system or municipality, you would get a water availability letter showing they had enough water to share with you. If you needed to drill your own well and were not exempt from above, then it got a little trickier.

In theory, if you had an old water right and wanted to move it to a new location… as long as you were pulling water from the same source, it was ok to transfer.

What happened in 2016?

Whatcom County got in a fight with Eric Hirst over water. In the initial court case, the decision ended up turning everything we used to know about water on its head. This single decision (turning that time from 2016-2018) had completely changed how counties approved or denied building permits for homes that we thought were permit-exempt wells for a water source.

So what happened next?

Essentially, the local counties had to become experts in all things water… overnight and without warning. No offense to most counties and cities out there, but they never had to be the water expert before… so how do you think it went when they now had to make decisions?

It went how you would imagine.

Some cities and counties said “no more building permits for you”. Some of them said “we will give you this building permit, but you can’t have any water.” Some of them said “you can build whatever you want, but you don’t get your building permit until you promise not to sue us if we’re wrong.” To be blunt, it was a mess. There was no clarity. Land values where water was questionable sunk overnight. Land values where water was clearly available went up and saw bidding wars. In certain areas, people began purchasing land just for the water rights.

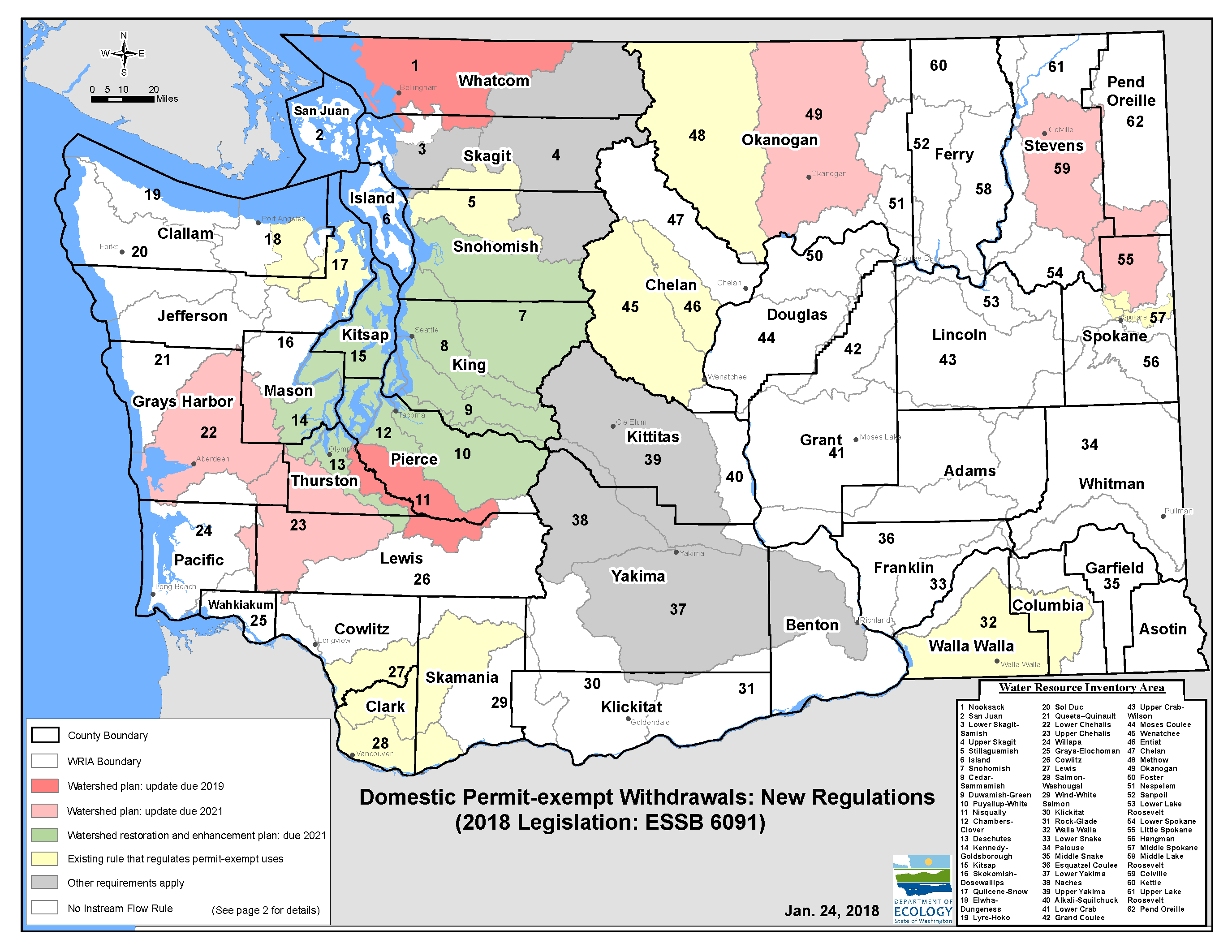

It was a continuous legal fight since 2016 and finally this ruling was overturned through a new law. Engrossed Substitute Senate Bill 6091 was passed on January 18, 2018 and was immediately signed into law the next day by WA Governor, Jay Inslee. This new law helps protect water resources while providing water for families in rural Washington.

What does this new law do? It’s not perfect, but it’s a really good start.

- The law focuses on 15 watersheds that were impacted most by the Hirst decision and establishes standards for residential permit-exempt wells. Now, the cities and counties can go back to some of the old rules and no longer be burdened with having to be an expert in an area they aren’t familiar with.

- The law divides the 15 basins into those that have previously adopted a watershed plan and those that did not. This adds clarity for how decisions are made.

- The law allows counties to rely on our instream flow rules in preparing comprehensive plans and development for water availability. That’s great, because the local jurisdictions just didn’t have the hours in to become the water experts on their own.

- It allows rural residents to have access to water from permit-exempt wells to build a home. All those people in the country just got to live in their homes again or finish building, which is great.

- Retains the current maximum limit of 5,000 gallons per day for permit-exempt domestic water use in watersheds that do not have existing instream flow rules.

- It lays out interim standards that will apply until local committees develop plans that are adopted:

- Allows a maximum of 950 or up to 3,000 gallons per day for domestic use, depending on the watershed they are in.

- Establishes a one-time $500 fee for landowners building a home using a permit-exempt well in certain affected areas.

- Invests $300 million over 15 years in projects that will help fish and stream flows (aka new jobs).

(Learn More: https://ecology.wa.gov/Water-Shorelines/Water-Supply/Water-Rights/Case-Law/Hirst-Decision)

So, after all this… will the local counties or cities change their tune and start issuing building permits again? Eventually, I think they will. Since this is brand new law, it will take a little time for the counties to evaluate how it impacts their decisions and development codes. However, with such an important topic, I believe that most counties are trying to respond as quickly as they can and issue building permits accordingly.

What impact does this have on old wells?

Not much. The law went into effect on January 19, 2018. All wells that were constructed prior to this date were subject to old rules which meant they had to show evidence of adequate water supply. All wells after this date are subject to the new law and new exemptions.

Which watersheds had previously adopted plans and is now subject to the 3,000 gallons per day with drawl? The Nooksack, Nisqually, Lower Chehalis, Upper Chehalis, Okanogan, Little Spokane, and Colville.

Which watersheds do not have a previously adopted plan and are now subject to a maximum withdrawal of 950 gallons per day? The Snohomish, Cedar-Sammamish, Duwamish-Green, Puyallup-White, Chambers-Clover, Deschutes, Kennedy-Goldsborogh, and Kitsap. These eight watersheds are also subject to curtailment during droughts reducing their use to 350 galloons per day for indoor use only.

Why all this talk about water?

First. We all need water and we probably take it for granted. Did you know that in just 2 years, Washington State has dropped from the 3rd best drinking water in the country to the 39th on the list! (source: Washington State Economic Climate Study 2017) If you have not seen the news, the South African city of Cape Town is likely to be the first major city in the world to run out of water. In my opinion, running out of physical water and running out of clean water… kind of the same thing.

Second. We all know someone who has land in a more rural area. There are a number of properties throughout Washington in some of our more rural locations who saw land values sink almost overnight if they didn’t have legally available water in use. That may have just changed. Give me a call to find out what it means.

Want to talk about your land value or how this may impact you?

(206) 293-1005 or jen@hudsoncreg.com any day except Sunday

Market Intelligence Matters.

Available Opportunities

Interested in investing in the real estate market in Washington State?

Check out what is available with the Hudson Commercial Real Estate Group www.InvestmentNW.com.

BREXIT. How Forces Influence Housing.

In case you missed it… recently the UK voted to Brexit from the EU.

BACK-UP.

This month’s read is less about the British withdrawal from the European Union and more about how world markets may or may not influence our local housing here at home in ‘Murica. Continue reading “BREXIT. How Forces Influence Housing.”

DEPRECIATION. An Imaginary Expense.

THIS ILLUSION IS ITS OWN MAGIC TRICK. NOW YOU SEE IT. NOW YOU DON’T!

Meet Jack. Jack is an investor. He has been doing this a while. He likes rental properties and has a lot of them. Continue reading “DEPRECIATION. An Imaginary Expense.”