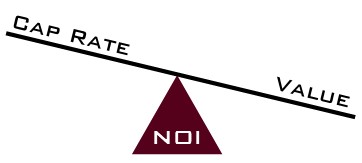

The capitalization rate is a fundamental concept in the commercial real estate industry. However, it is often misunderstood, even by those within the industry. My goal is to give you a solid understanding of the concept of a cap rate and to explain when this tool is useful, and when it is not. Continue reading “What is a cap rate?”

1031 Exchanges That Don’t Work

Tax Deferred Exchange Tips for the Real Estate Professional, courtesy of Kevin Hummel, McFerran & Burns, PS.

Exchanges That Don’t Work

I really enjoy being positive and creative. It is absolutely exiting to help people find new solutions to their capital gains challenges, but sometimes I have to be the bearer of bad news. Sometimes I just have to give you the information you did not want to hear. Continue reading “1031 Exchanges That Don’t Work”

Profit & Loss Statements – a necessary evil

We all hate preparing profit and loss statements, but they are necessary in the course of business. The following information is courtesy Richard J. Welt, Attorney at Law with McFerran & Burns, P.S.,Practicing Real Estate Law in Western Washington since 1986. Contact: (253) 284-3811 or www.mbs-law.com. While this article was tailored to fit with their bankruptcy series, it is also great advice and what you’ll need to prepare to apply for a loan as well.

Continue reading “Profit & Loss Statements – a necessary evil”

Bankruptcy for Small Business Owners

This information is courtesy Richard J. Welt, Attorney at Law with McFerran & Burns, P.S., Practicing Real Estate Law in Western Washington since 1986. Contact: (253) 284-3811 or www.mbs-law.com

Bankruptcy for Small Business Owners

Filing bankruptcy if you have an interest in a corporation or a Limited Liability Company requires some extra work for you and your bankruptcy lawyer. Preparing an accurate balance sheet listing the company’s assets and debts is a critically important part of this process.

Keep in mind that just because you file bankruptcy doesn’t mean that your Limited Liability Company or corporation should file bankruptcy. You are not the company, and the company is not you. Your Limited Liability Company or corporation is a separate entity under the law. Continue reading “Bankruptcy for Small Business Owners”

Highest & Best Use. Well.. that’s not exactly a buzzword, is it?

The words “Highest and Best Use” don’t seem to create a lot of flurry or excitement. I see any sellers and even agents marketing property for what it is, without really exploring other potential uses. As a result, it costs them in the long run when it comes time to sell or lease.

Continue reading “Highest & Best Use. Well.. that’s not exactly a buzzword, is it?”

Good intentions do not replace a qualified appraisal, by Mark Lee Levine

In the recent case of Joseph Mohamed Sr., et. ux. v. Commissioner, T.C. Memo 2012-52, the U.S. Tax Court determined that a taxpayer and his spouse, after making almost $20 million worth of charitable real estate gifts to qualified charitable recipients, could not take the $18.5 million tax deduction for the gifts.

The reason is a failure to follow Internal Revenue Code regulations and use a qualified appraiser. As this case illustrates, in charitable contributions of this size, if such steps are not properly undertaken, there can be a complete loss of the deduction. Continue reading “Good intentions do not replace a qualified appraisal, by Mark Lee Levine”

USDA Financing – Continued Resolution Passed by Congress

UPDATE – Congress has passed temporary Continued Resolution meaning that changes to USDA Rural Housing eligible areas has been delayed until mid December.

What does this mean for PrimeLending and USDA Rural Housing? Continue reading “USDA Financing – Continued Resolution Passed by Congress”

How to Be a Savvy Loan Shopper

Be a Savvy Loan Shopper… by Jen Hudson, GRI

When buying a car, you want go out and compare the best deals available, right? If you find a car that is a “steal,” then you know you should look a little closer at the details and ask why. Are they offering a warranty, a dealer incentive or maybe you are trading something else in. Would you agree that these different details could drastically impact your final sales price?

Well, the same principal applies when shopping for a home loan. You certainly don’t want to wind up with a lemon, so learn to be a savvy shopper. Here are some tips and common mistakes people make when shopping for a home loan. Continue reading “How to Be a Savvy Loan Shopper”

Be the Bank

Let’s admit it. Making money in real estate during times of appreciation and free flowing financing does not take skill, negotiation or fluent understanding of the market. For the last decade, you could have pretty much bought something with your eyes closed and still made money the next year. Did you notice that “real estate investors” started coming out of the woodwork? Of course, now we have “foreclosure specialists” and “short sale experts,” but that discussion is for another day.

Today’s market takes skill, knowledge, creative thinking and… hard work… so, where did those guys go? Continue reading “Be the Bank”

Foreclosures, Mortgages & Boundary Line Adjustments.. oh my!

Foreclosures, Mortgages & Boundary Line Adjustments.. oh my!

Here is a perfect example of why you should ensure all parties are on board for any legal or real estate transaction. If you have any questions about what you’re trying to accomplish, talk to an expert.

Question:

Property owner owned two adjoining lots. Each lot was separately mortgaged. Owner completed a boundary line adjustment through the county, effecting an equal land trade between the two lots, but never notified either mortgage holder of the BLA. Subsequently, one mortgage holder foreclosed and took title to one of the lots. What was the effect of that foreclosure on the BLA? Continue reading “Foreclosures, Mortgages & Boundary Line Adjustments.. oh my!”