COMMON SENSE IS A FLOWER THAT DOES NOT GROW IN EVERYONE’S GARDEN.

Do you ever feel like you are the only one drinking Diet Coke in a casino full of boozing people?

Yeah, me too.

On one side, I see the continuous string of headlines like…

- GE Capital’s real estate assets s

old for $26.5 billion, the largest deal since Blackstone’s acquisition in 2007;

old for $26.5 billion, the largest deal since Blackstone’s acquisition in 2007; - Fourth Quarter Surge Lifts Multifamily Investment Sales to New Records in 2015.

- Chicago’s 110-story Willis Tower sold for $1.3 billion, the highest price per square foot paid for an office tower outside of New York City;

- Marriott purchases Starwood for $12.2 billion, creating the largest hotel company in the world.

- Seattle is beyond a seller’s market.

Despite the record breaking headlines… some eight years after the Great Recession, the uncertainty still comes up in daily conversations too.

We are seeing a continued global economic slowdown that includes China. We are constantly hearing about new acts of terrorism. The Federal Reserve has raised the federal funds rate, just as central banks increase their quantitative easing efforts. Heck, the only thing the election has managed to teach me this year is that anyone can grow up to be President.

So, what is reality?

The investment climate for commercial real estate continues into 2016 with amazing momentum. It is attractive for three main reasons:

1) The U.S. economy remains strong compared to other economies;

2) Interest rates remain low and likely will through this year;

3) Capital continues to pour into investment real estate, further driving up prices and values.

REAL ESTATE IS A SELLER’S MARKET IN 2016.

Why do I know this? Because look at the other options… that’s why.

Prices in major markets are increasing, and we are seeing this continue in the secondary and tertiary markets as well.

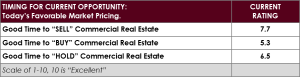

As part of my due diligence for staying on top of trends, I am constantly watching new surveys and reports. One of those is Situs RERC (Real Estate Research Corporation) who has a quarterly trends report.

They have a typical scale with a 1-10 rating, 10 being excellent. With that, they then ask some basic questions regarding the market place and environment for certain activities to agents, owners, and all sorts of people heavily entrenched in the industry.

At the end of 2015, the ratings are noted below.

What does this response tell us?

These responses, combined with the other factors noted previously, have a clear message.

SELL NOW.

If you want to make more money now than you will later, you should sell your properties and probably in 2016-2017.

Keep in mind, not all property types and not all locations are created equal. Some property types have a little further to run up in values than others. Some locations have a little further to run up. For other properties and locations it may be best to get out early, so you can avoid any sudden market shifts.

Let’s look briefly at the typical real estate cycle before we go further.

REAL ESTATE CYCLE

Like many things in the world, real estate cycles through phases. It always has and it will continue to do so.

Here’s how it works… Try not to let your eyes glaze over.

We have come through the Recession years. This is when vacancy rates are climbing, prices are dropping, and it feels like we are in a free fall. Remember 2009ish? Yeah. That was it.

Then, we start to find our foot and dig our way out of the hole. That’s a Recovery. Vacancy rates start to improve. Sales are more predictable. Prices are a little more stable. You can breath again.

Then we hit Expansion. Vacancy rates are way down. New Construction starts to build. Prices head up. Good times feel like they will never end. (Psst… we’re here now.)

Until, eventually you hit the tipping point into Oversupply. We’re still building (because it started earlier) but vacancy rates are starting to climb. Prices are slowing. You keep going anyway because that is what you are used to and you don’t realize what is going on.

Then one day, it feels like a Recession comes out of no where… and we go through the cycle all over again.

THIS IS NOT, I REPEAT NOT, DOOM AND GLOOM.

Where are we today? Definitely in the Expansion Phase. That’s ok though. It’s great to be here when you are a seller.

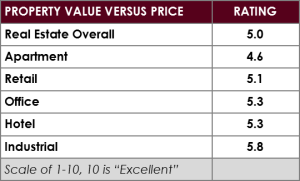

Remember those Situs RERC people? They also broke the survey down into property or asset types and looked at today’s values versus the historical price versus value figure.

After reviewing these ratings, what have we learned?

After reviewing these ratings, what have we learned?

Apartments are offering a much lower “value versus price” rating than some other property types when you look over the years. It appears that the “go-to” property that everyone wants to invest in is generally overpriced compared to the value, with a 4.6 rating. The Industrial buildings are the shiniest penny in the pile right now at 5.8.

So, what does this all mean to you, as a real estate property owner?

Once you put all these pieces together, you can see that the market is willing to pay (sometimes a ridiculous amount of) money for your real estate right now. It won’t be forever.

Know what I would do if I was a seller today? Wait…. Let me rephrase the question.

With an exception to the core properties that I plan on retiring with… Do you know what I AM doing as a seller today? I’m getting off the fence and putting my properties out on the market.

Know what I’m finding? People are willing to pay. Inventory is limited. Real estate looks better than the other investments available to buyers. So, what should sellers do?

Well, I will continue to sip Diet Coke while everyone else has rum in theirs. It’s all good to me. I am happy to take advantage of the overpricing in certain sectors. (Did I just say overpricing? Yes, yes I did.) All bets are off once we cycle into the next phase… maybe around 2018?

Want to know how much you might be missing out on in your properties? You can find me any day except Sunday. Call/text me at (206) 293-1005 or email: Jen@HudsonCREG.com