There is no such thing as a “no-cost” loan. But these options may help.

If you haven’t seen the “no cost” loans yet, you will. I promise there is big push for “zero cost” or “no cost” loans coming soon to a lender near you. Why do I know this? Because lenders are in the business of making loans, and they are running a little short right now.

First things first. I usually define free as something that is actually, ummm, free. I’m not comfortable with the idea that when consumers end up paying higher monthly fees but maybe zero money out of pocket, that it is somehow still considered “free”. But, that’s me.

Between our available housing challenges (which means fewer loans) and the never-ending race to the bottom (means higher automation, lower service, and less profit), lenders are going to get more creative, so they can continue to approve more loans. Because… businesses still need to make a profit.

Please don’t mis-interpret. Creative doesn’t necessarily mean bad. In fact, with such a shift in our loan guidelines, we could honestly use a little more risk in the market; the loans today are safer than they have ever been.

We will cover the topic loans, employment, and affordability more next month with our state of the market report.

BACK TO THE “NO-COST” LOANS.

While banks and lenders… and even real estate agents (looking straight at you Keller Williams) may have good intentions, there are some things you should be aware of next time you need a mortgage, whether it is for a purchase, refinance, or line of credit.

For starters…. There is no such thing as a “no cost” or “free” loan.

You would know this by looking at a typical rate sheet.

Wait. Back-up. What’s a rate sheet?

A rate sheet is the piece of paper that tells loan officers how much a loan will cost, so they can quote fees and rates appropriately.

MOVING TARGETS

The not so fun part about rate sheets is that they are moving targets. Remember the whack-a-mole game at the fairgrounds? You had to watch for the thing to jump up, just so you could try and whack it down before it disappeared? Interest rates on your loan are kind of like “whack-a-mole” in the sense they are ever changing. When you want to “lock” your loan, then you’d better have good aim and hit that little mole right on top of the head!

Each week, or day, or hour… whatever the market calls for at that time, a lender is provided with a new rate sheet for that moment in time. Think of it like a snapshot, not a video that reflects movement.

Remember when you started your house search and rates were at 4.5%? Now, 6 months later after losing out on 4 other properties, you finally get one under contract just to have your interest rate at closing be 5.125%? What happened in that time that caused the banks to reprice their loans?!?

A lot of things in a lot of different places. The investors on wall street had a change of heart about the market and their projections of the future. Why? It could be a million reasons that changed their outlook. Maybe the unemployment numbers were released, and they got nervous. Maybe the Fed made a comment at a meeting that made them feel warm and fuzzy. Maybe there was more nuclear “posturing” between countries or another new tariff announced that made them turn tail and run to safety. Or, a million other things that aren’t related to housing yet impact your ability to buy a house right now.

THIS DOESN’T SEEM FAIR. It’s not, but that is how it is. This is also why our team watches far more than just housing trends. Every. Single. Day. And for your benefit.

In addition to the ever-moving whack-a-mole on rates, the interest rate you are even offered depends on your credit strength, how much money you are putting down, and how many properties you own.

PERSPECTIVE

While it seems a little backward, the more properties you have or more loans against your name… the more money you are required to put down and/or possibly the higher the interest rate on that loan. For example, Freddie Mac might not like it if you have more than 6 properties financed. Therefore, as soon as you want to buy property number 7, you don’t get loan requirements quoted from Freddie anymore because you are rejected from their pool. So, maybe you look at Fannie Mae’s 5-10 property program instead. Expect, Fannie doesn’t like it if you have more than 10 properties, so when you want property number 11, now you get to jump into another pool of investors and their rates or requirements.

While you want to believe that by owning 10 properties, then you must be a great credit risk because you can show lenders that you are able to make loan payments on all 10! The reality is instead of your rosy outlook, you are viewed as a higher risk by the bank. Now have 10 different loans you might default on, not 10 examples of why you are good at paying bills.

It’s all in the perspective.

BACK TO THE RATE SHEET.

I consider myself pretty decent with numbers and math, but rate sheets even cause me to sit back and pause for a moment, so I can consider the options before choosing one. It’s not as straight forward at it seems at first. You want to factor in how much cash you have on hand, what it costs you, and what your plans are for the property. And, don’t forget the “what if” plan B too.

Deep breathe. Let us break it all down for you so it’s easy to understand. Plus, if you follow the equations, it gives you a cheat sheet to help make your decisions easier.

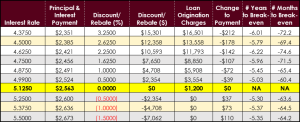

SAMPLE RATE SHEET:

Confusing, right?

Let’s make it simple. The Story of Dr. Pepper.

Dr. Pepper and his family are buying a house in Mill Creek. It was listed for $599,950, but after an inspection they found out that their dream home needs a new roof so they agreed to reduce the price to $588,500.

Dr. Pepper has been saving his money, has good credit, and will put 20% down. That leaves a loan amount of $470,800.

Purchase price $588,500

Less 20% down -$117,700

Loan Amount $470,800

With this loan amount, type of loan, and his credit already considered, he still has a variety of options for his loan.

First, consider the “no discount” loan or what a loan would look like without any adjustments to the interest rate or payments.

VERSION 1: STRIP IT DOWN.

This is simple. You just find the row on the chart that has ZERO in the discount/rebate column.

Cheat Sheet: Discount = money you pay in exchange for cheaper rates

Rebate = money you receive in exchange for higher rates

At 5.125%, Dr. Pepper’s mortgage payment (principal & interest only) will be $2,563/month and his loan costs would be $1,200.

Version 2: The Discount Disco.

Let’s say that Dr. Pepper decides he would rather have a 4.5% interest rate, instead of the 5.125% rate. He is just more comfortable with a payment below $2,400.

What does this option look like?

At 4.5%, his new payment comes down all the way to $2,385/month. That is a “savings” of $178 per month… but is it really? Let’s look.

This loan has a cost of $12,358. That means, Dr. Pepper needs to pay additional money at the closing to lower his interest rate and monthly payments for the life of the loan.

Is it worth it? That depends.

If Dr. Pepper pays $12,358 up front, he gets to save $178 per month…. forever. But, exactly how long does it take to make up that difference? 69.4 months or 5.79 years. How do you calculate this? It’s simple.

$12,358 (loan costs) = 69.4 months = 5.79 years*

$178/mo (change to payment)

Does Dr. Pepper plan on owning this home for longer than 69.4 months?

If he wants to own it for a long time, then it would make sense to “buy down” the interest rate for the lower payment. However, if Dr. Pepper thinks he might be selling again within the next 5-6 years… then he should probably just suck it up and keep the higher rate and payment.

Version 2.1: The Discount Disco Lives On.

You notice I used the word “selling”. I didn’t say “moving”.

Why?

Well, if Dr. Pepper plans on moving in 5 years, but keeping the property as an investment or rental, then he will still have the mortgage and fixed payments for much longer than 5.79 years. Even when he moves to his next home, he will still benefit from the lower payments and now increased cash flow from his new rental.

Version 3: Cash Grab Fever.

Let’s say that Dr. Pepper has had a change of heart. His daughter was just accepted to medical school, so he needs to try to keep as much cash as possible in his pocket with this purchase, and maybe get a little back to help cover some of his closing costs, if possible. After all, he does have to replace the roof after he moves in and was hoping to cover all of his title/escrow fees ($2,400), appraisal ($900), and property insurance premium ($1,400) at closing, which is around $4,700.

No problem. Let’s look at Dr. Pepper’s options.

Title/Escrow Fees $2,400

Appraisal $900

Property Insurance $1,400

Total Additional Costs $4,700

With an interest rate of 5.375%, he can receive a rebate of up to 1.0% of the loan amount or $4,708.

Loan Amount of $470,800 x Rebate of 1.0% = $4,708 in Credits at Closing

This does increase his payment to $2,636/month, up $73 from the starting point. How long will it take to make up the difference between his increased payment and the credit he receives at closing? 64.5 months or 5.37 years.

$4,708 (loan credit) = 64.5 months = 5.37 years

$73/mo (change to payment)

Remember this scenario was reversed. Now he gets money back up front for a higher mortgage payment. To put it directly, if Dr. Pepper plans on selling or refinancing longer than 64 months, then he should just pay his expenses out of pocket. In this scenario, owning the property for longer than 64 months actually costs more money over time.

For example, let’s say that Dr. Pepper owns the home for 8 years. That means he will make 96 mortgage payments (8 years x 12 months = 96 payments).

Now, if he is paying an extra $73/month for all 96 payments, that means he is paying out $7,008 total… in exchange for a $4,708 credit up front.

$73/month x 96 payments = $7,008 in additional monthly fees

$7,008 in fees—$4,708 loan “credit” = $2,300 in additional payments

While this seems a little backwards in the long run, it did allow him to purchase a property AND keep a little more cash in hand, which is always an option. Plus, there is the “time-value of money” conversation, but that is for a different discussion.

Where I get concerned is when you are offered the “no cost” version of the loan, but then are not given the whole picture, or worse, you don’t get to receive the full benefit available. No one wants to pay higher monthly fees unless they receive the full benefit up front.

If you are afraid you might be in a tricky situation, call us and we will help you sort it all out.

The rate sheet examples in this newsletter are courtesy Kevin Everett with Evergreen Home Loans. If you have loan questions, he is one of our favorite loan experts.

You can reach Kevin Everett at (425) 232-3672 or KEverett@EvergreenHomeLoans.com

We believe that YOU should have the power to decide what is best for your family. The next time you need a mortgage, make sure you are working with a lender who understands your situation and explain the options.

When you need resources for knowledgeable lenders who care about your ultimate success, we have good people on our team you can talk with. And, if you find yourself stuck working with a lender who doesn’t understand all the pieces, then we can still help you at least get a better understanding of the options you are facing.

Jen Hudson | (206) 293-1005 | jen@hudsoncreg.com

Duane Petzoldt | (425) 239-1780 | duane@hudsoncreg.com

MARKET INTELLIGENCE MATTERS.