STATE OF THE MARKET, 1ST QUARTER 2018

We believe that the housing market is a lot more than just homes. This graphic (below) is oversimplified, but just think about all the interlocking pieces involved for our world to function.

Now with this big picture view in mind, let’s talk about what is going on in Washington State today.

Now with this big picture view in mind, let’s talk about what is going on in Washington State today.

The Washington State economy added 96,900 new jobs over the past 12 months, representing an annual growth rate of 2.9%—still solidly above the national rate of 1.5%. Most of the employment gains were in the private sector, which rose by 3.4%. The public sector saw a more modest increase of 1.6%.

The strongest growth was in the Education & Health Services and Retail sectors, which added 17,300 and 16,700 jobs, respectively. The Construction sector added 10,900 new positions over the past 12 months. 10,900 jobs in Construction is a start, but let’s face it… we need a lot more than that to catch up with our housing demands.

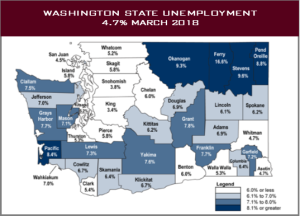

Even with this solid increase in jobs, the state unemployment rate held steady at 4.7%—a figure that has not moved since September of last year. Remember, the unemployment rate only counts people who are looking for jobs in the workforce, not people who can’t work or who are sitting on the sidelines.

We expect the Washington State economy to continue adding jobs in 2018, but not at the same rate as last year. Why? A couple reasons. One, employers only hire as many people as they need to run a company. If employers are already fully staffed, then their business demands need to increase before making new jobs. Plus, you can’t have new jobs without people. If people are not able to work, or choose not to work, then you can’t hire them. It’s that simple. That said, we will still outperform the nation as a whole when it comes to job creation, as we have a lot of stable and “needs-based” industries here, such as Health Care, Aerospace, Education, and Transportation.

Where did we lose jobs? Manufacturing. Our Manufacturing sector has lost 5,700 jobs this past year, with another loss of 3,300 projected.

Where else are we paying attention? Aerospace. There is some concern that President Trump’s steel and aluminum tariffs could hurt manufacturers such as Boeing. While much of Boeing’s material is sourced domestically, many of their orders come from China. If China decides to retaliate, they could easily shift their orders over to Airbus, which would hurt our local economy. On a good note, there is a growing demand for cargo planes, which means the 767 line in Everett is expected to increase, along with 737s and 787s.

This increase in cargo planes also supports what we are seeing down in the Ports. The container volume (you know, the giant metal containers that go from ships to trains to trucks to stores) was up 6% in February, and our breakbulk volume (meaning things that need to be loaded individually, like oil in containers or apples in crates) was up almost 30%. The one shipment that has been down consistently? Auto volume, which was down 8% in February.

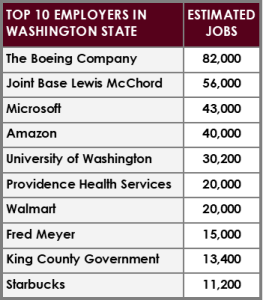

What other major companies drive our local economy besides Boeing and the Ports?

Amazon. They currently have 8.1 million square feet of office space, which is expected to soar to 12 million square feet within the next 5 years. Amazon’s search for H2 has concerns for slowed hiring locally, but regardless they are still one of our heavy hitters when it comes to employment. Microsoft is also talking about expanding their Redmond Campus, which means ultimately renovating 6.7 million square feet and building another 2.5 million square feet by the end of 2020. Other major drivers in our local economy for office space are a mix of both old and new tech companies, including Cisco, Apple, eBay, AirBNB, Uber, Snap, Alibaba, Tableau, Valve, and Wave Broadband.

Amazon. They currently have 8.1 million square feet of office space, which is expected to soar to 12 million square feet within the next 5 years. Amazon’s search for H2 has concerns for slowed hiring locally, but regardless they are still one of our heavy hitters when it comes to employment. Microsoft is also talking about expanding their Redmond Campus, which means ultimately renovating 6.7 million square feet and building another 2.5 million square feet by the end of 2020. Other major drivers in our local economy for office space are a mix of both old and new tech companies, including Cisco, Apple, eBay, AirBNB, Uber, Snap, Alibaba, Tableau, Valve, and Wave Broadband.

On the slower side we have retailers. We are going to lose some major stores this year both locally and nationally due to closures, including Macy’s, Sears, Kmart, Toys R Us, and Babies R Us. Despite this, there are still new retail stores and centers under construction, with others moving toward more of a mixed-use design.

Home Sales Activity: Western Washington

- There were 14,961 home sales during the first quarter of 2018. This is a drop of 5.4% over the same period in 2017.

- Listing inventory in the quarter was down by 17.6% when compared to the first quarter of 2017, but pending home sales rose by 2.6% over the same period, suggesting that closings in the second quarter should be fairly robust.

- The takeaway from this data is that the lack of supply continues to put a damper on sales. We also believe that the rise in interest rates in the final quarter of 2017 likely pulled sales forward, leading to a drop in sales in the first quarter of 2018.

- Anyone expecting to see a rapid rise in the number of homes for sale in 2018 will likely be disappointed. New construction permit activity—a leading indicator—remains well below historic levels and this will continue to put increasing pressure on the resale home market.

Annual Changes in Home Prices: Western Washington

- With ongoing limited inventory, it’s not surprising that the growth in home prices continues to trend well above the long-term average. Year-over-year, average prices rose 14.4% to $468,312.

- Economic vitality in the region is leading to robust housing demand that exceeds supply. Given the limited number of new construction homes, there will continue to be pressure on the resale market. As a result, we believe home prices will continue to rise at above-average rates in the coming year.

- Mortgage rates continued to rise during first quarter, and are expected to increase modestly in the coming months. By the end of the year interest rates will likely land around 4.9% +/-, which should take some of the steam out of price growth. This is actually a good thing and should help address the challenges we face with housing affordability—especially in markets near the major job centers.

While the housing market is great today, please keep in mind that everything cycles. Will home values drop tomorrow? Probably not. Keep an eye on interest rates and your timing in the market if you want to make any moves in the future. Need help trying to predict the future? Give us a call or email to stay ahead of the trends.

Jen Hudson (206) 293-1005 and Duane Petzoldt (425) 239-1780